Editorial

DOI:

https://doi.org/10.34624/ijbi.v1i4.31059Keywords:

EditorialAbstract

One year has passed and the first volume of IJBI (International Journal of Business Innovation) presents its fourth and final issue. This is, in fact, an important milestone for the life of this journal, which we hope will be long and fruitful. The editorial team is very glad about this first volume, composed of 19 articles published in the 4 issues, and considers that, as this is the first year of the journal's life, it was very successful, both in terms of quantity and quality of the articles submitted and published, which will serve as a reference for future volumes.

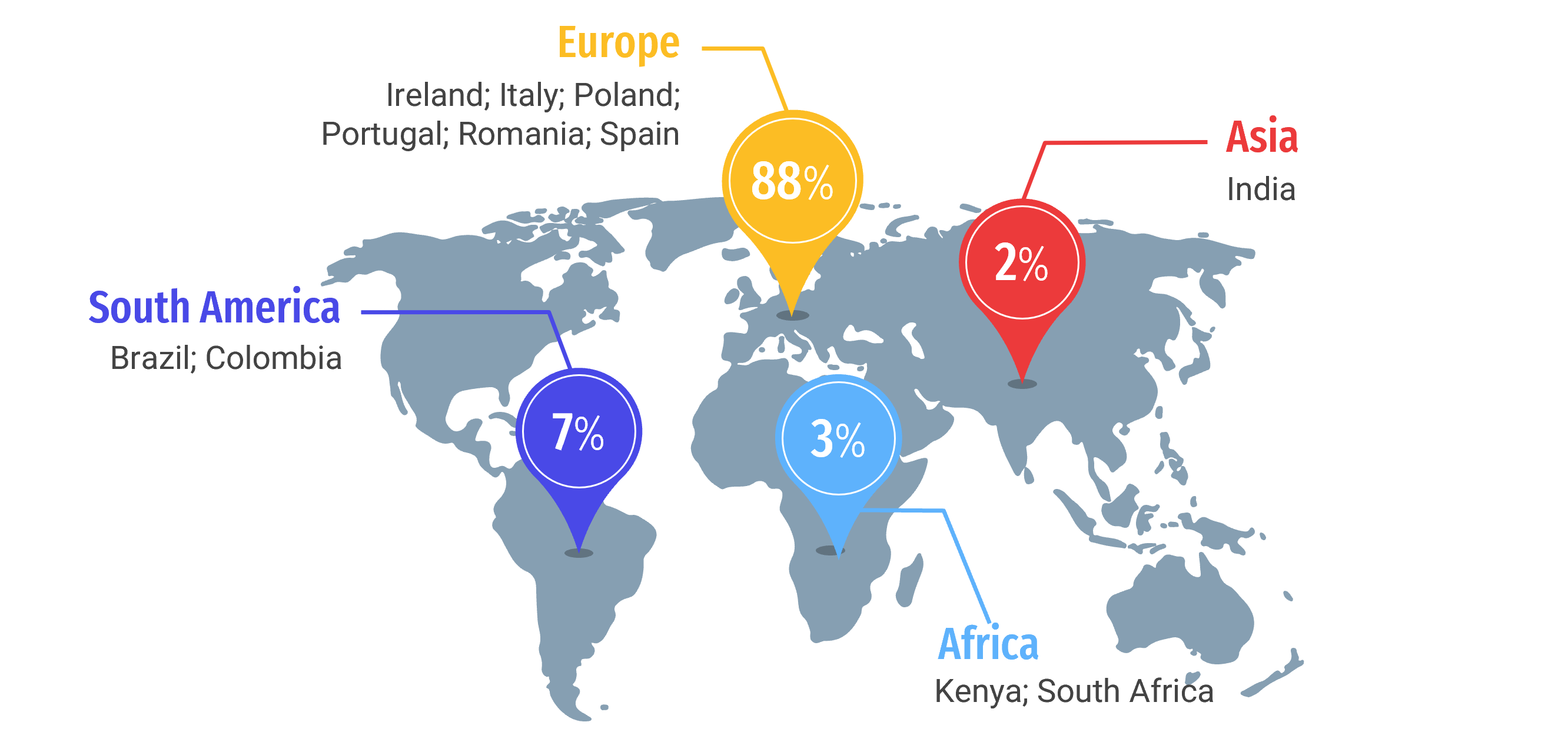

There are several reasons that boosted this success, to which the editorial team is grateful. First, a special thank you to the 90 members of the Editorial Review Board, scattered around the world (Figure 1). The members of this board are the highest experts in the IJBI topics and are directly responsible for the quality of the journal, ensuring the highest rigor in the double-blinded review process. As such, as editors, we would like to thank them for all their work, support, and assistance.

Figure 1 - Origin of Editorial Review Board members

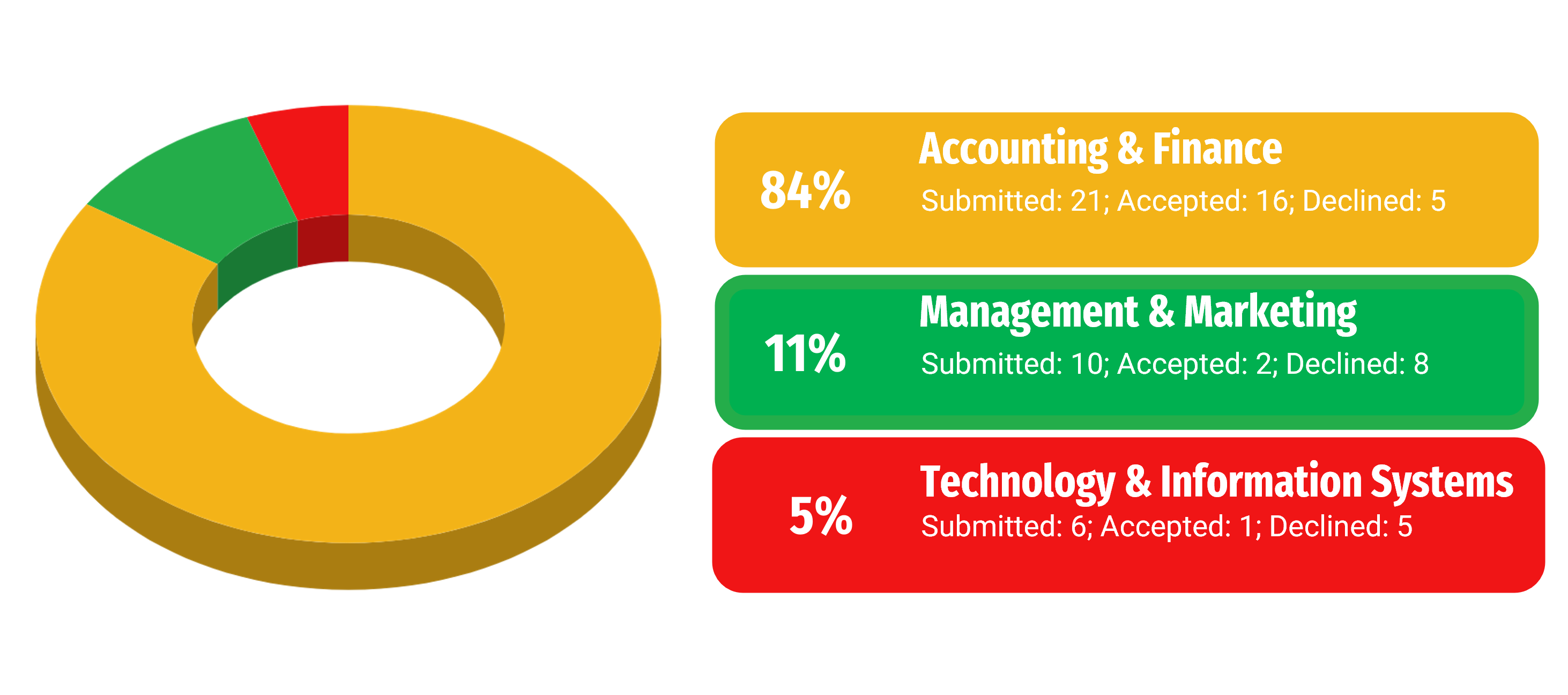

During the year, we received 37 submissions. Of these, 18 were declined and 19 were accepted for publication. That is, the acceptance rate in this first volume was 51.4%. Of the 19 articles published in this volume, most are on the topic “Accounting and Finance”, as illustrated in Figure 2, and it is also worth noting that there was no publication on the topic “Tourism & Society”.

Figure 2- Topics of the published articles

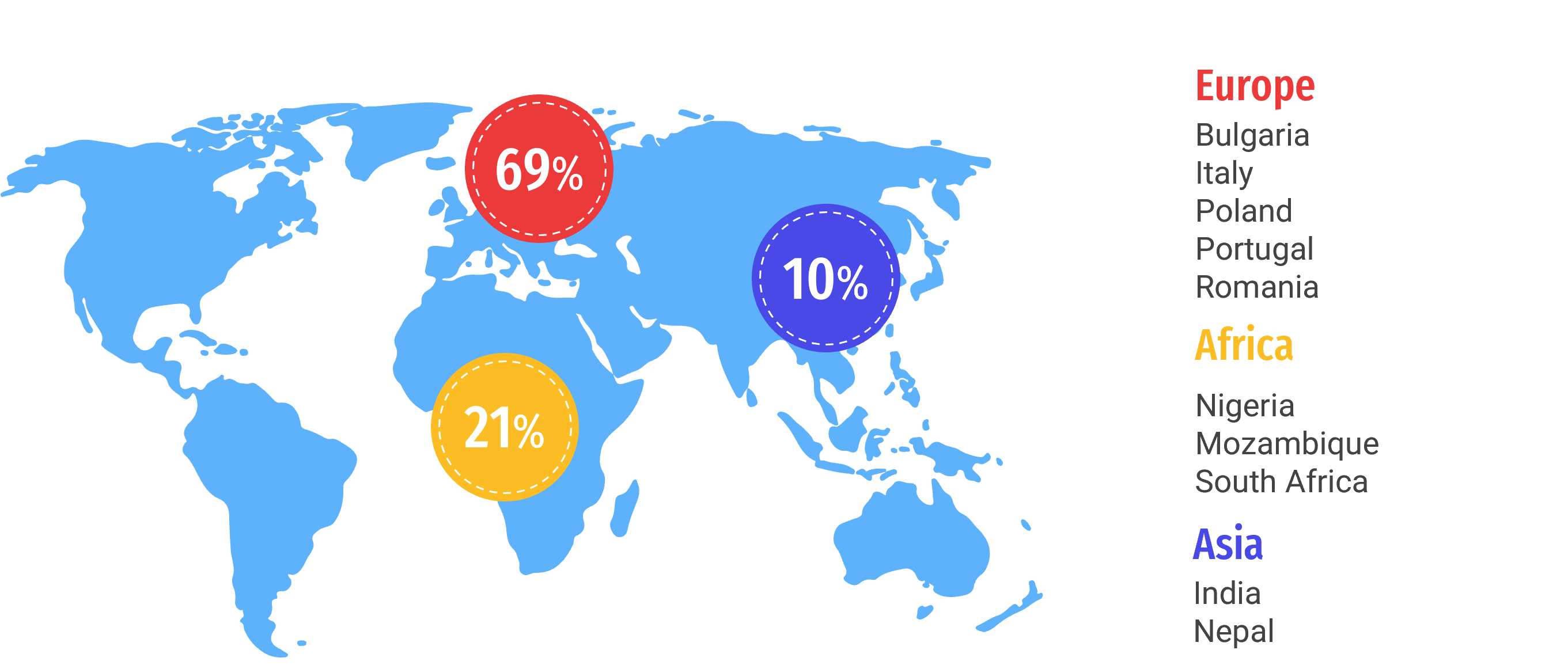

Furthermore, it should also be noted that Volume 1 presents very different contributions from different and completely different contexts and realities. One of the factors that contributes to this diversity is related to the origin of the authors of the published articles. As we can see in Figure 3, most authors come from Europe, but a significant percentage of authors are affiliated with African and Asian institutions. As editors, we want to give a very special thanks to all the authors who have trusted IJBI to submit and publish their articles. This trust is essential for the existence and growth of our journal.

Figure 3 - Authors' affiliation

This issue is made up of 5 articles, all belonging to the topic "Accounting and Finance", more specifically in the area of Accounting, but on quite different subjects as shown below.

The first article is titled "The Main Gaps and Nonconformities Identified in the Accountability in SNC-AP" and is authored by Daniela Teixeira and Patricia Gomes. This study, focused on the period from 2018 to 2020, analyzed the application of the new public accounting model based on IPSAS (SNC-AP) by Portuguese Polytechnics and understand the main gaps and nonconformities identified by the external audit. The main results show that entities have paid more attention to formal compliance with the presentation of the financial statements, neglecting some more specific aspects such as the disclosures and descriptions in the Annex and the recognition of income with and without consideration. The study helps to clarify areas where there is a need for more training and clarification on the part of professionals in order to increase compliance with the new regulations.

The article “Inventories Discretionary Management through Real Activities: The Case of Small and Medium-Sized Portuguese Companies in Commercial Sector” by Maria Filipa Miranda Nogueira, Augusta Ferreira and Carlos Ferreira focuses on the discretionary management of inventories based on real activity and the repercussions on the financial statements, considering the case of 30,797 Portuguese Small and Medium-sized Enterprises from the commercial sector. The results state the discretion included in inventory management is related to commercial management and confirmed that managers seek to act in a way that maximizes their welfare by using discretion.

Considering the reform initiated with the publication of the International Public Sector Accounting Standards (IPSAS), Carla Brito and Amélia Pires aims, in their article “Public accounting in Cape Verde: Current Situation and Future Perceptions”, to identify the degree of implementation and adequacy of the applicable regulation in Cape Verde and the future perception of a possible reform to accounting IPSAS. Using an interview survey, applied to senior technicians of the Public Administration of Cabo Verde, authors point to the existence of some weaknesses and inoperability, resulting from the current regulation, but which are due its low degree of its implementation and not to its inadequacy.

Piotr Luty and Rui Costa, in their article “Benford's Law in the Analysis of Inventories of Portuguese Companies”, aim to check whether the financial data disclosed by companies comply with natural laws in terms of the resources used. The authors analyzed the inventory values of Portuguese companies in the years 2016 – 2020 and the results indicate that for real estate sector, there is no consistency with the Benford distribution, suggesting a deeper analysis of the results, which will be continued further research.

Finally, the article “Corporate Effective Tax Rate: Brief Literature Review” by Gisela Pinto Oliveira, Sérgio Cruz and Vera Silva present a brief literature review on the effective corporate tax rate, emphasizing its determinants, namely the size, the leverage, the capital intensity, the stock intensity, and the return on assets. The study detected evidence of a significant relationship between the effective tax rate and the determinants analyzed.

Thank you for your interest in the IJBI.

References

Downloads

Published

Issue

Section

License

When submitting an article to the IJBI, authors certify the following clauses:

-

Originality and single submission– The contents presented in the article have not been published previously in whole or in part, and were not submitted or are not under active consideration elsewhere prior IJBI decision. The article must be authentic and does not contain plagiarism.

-

Authorship– All authors reviewed the article, agreed with its content, and agreed to its submission to the IJBI.

-

Conflicts of interest– Any conflict of interests must be declared. If authors have no declaration, it should be written (in the acknowledgments section): “The authors declare no conflict of interests”.

-

Ethics committee and informed consent(if applicable) – The research must be approved by an independent ethics committee and subjects gave their informed consent before they were enrolled in the study.

- Authors retain copyright and grant the journal the right of first publication with the work simultaneously licensed under a Creative Commons CC BY 4.0.